27 Draw Against Commission Pros And Cons

2 you have the potential to make a lot of money; When employers use this payment structure, they pay employees a draw amount with every paycheck. Read our article to learn everything you need to know! Commission is commonly found in real estate, sales, and various finance sectors. Web draw against commission:

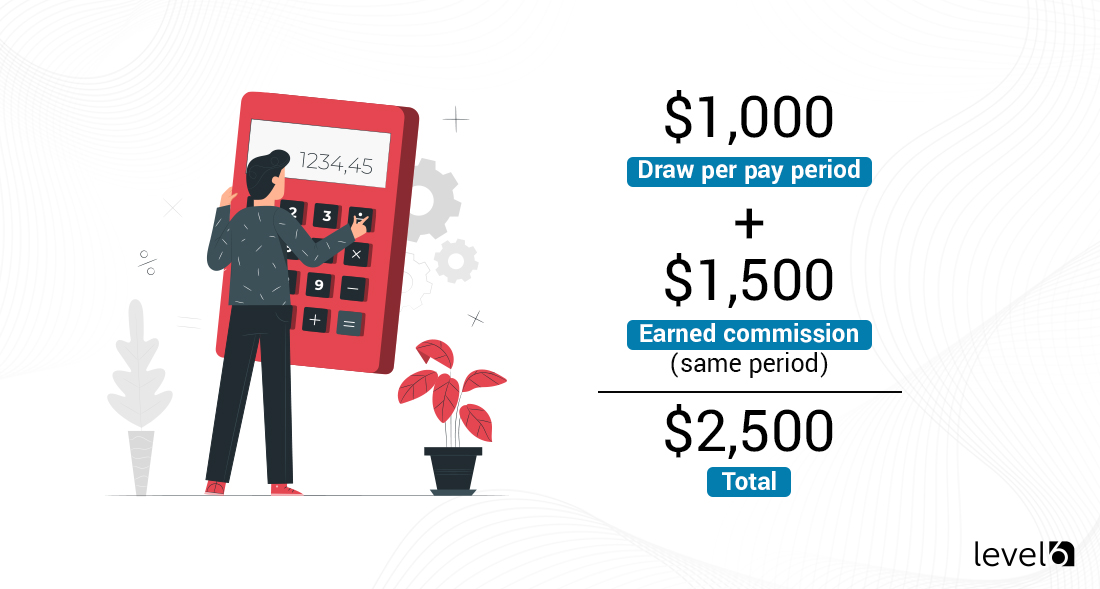

Web sales draws are a commission advance given to a. 5 you can work from home; Commission serves as a motivating factor for an agent/representative to complete a deal and can even help align the performance of an individual with the organization. Web draw against commission percentage of salary each has its own pros and cons, ranging from the consistency of the number on your paycheck to the actual number you can expect to see on your paycheck — some of which can be quite large. A commission draw, also known as a draw against commission, is one of the most common ways to pay commission to salespeople.

What are the types of draw against commission arrangements? Web pros and cons of draw against commission. The pros of using draw against commission include: 2 you have the potential to make a lot of money; A draw against a commission pay structure can take one of two forms:

FAQ What Are The Pros and Cons of Straight Commission Plans?

The more you sell, the more money you'll make. Web draw against commission: Commission serves as a motivating factor for an agent/representative to complete a deal and can even help align the performance of an.

11 Sales Compensation Plan Examples To Inspire Reps Mailshake

3 you don’t have to answer to a boss; Salespeople might feel less motivated to reach their full quota, as their pay isn't directly tied to their sales performance. What are the types of draw.

FAQ What Are The Pros and Cons of Straight Commission Plans?

When a company offers a draw against commission pay, it gives the employee a set amount of money at the start of their employment. The more you sell, the more money you'll make. 1 you.

What Is a Draw Against Commission? Examples & More

Web draw against commission: Web draw against commission: Web drawbacks of a draw against commission. Web commission is a form of compensation awarded for facilitating or completing a transaction. Creates a safety net for new.

11 Sales Compensation Plan Examples To Inspire Reps Mailshake

Web draw against commission percentage of salary each has its own pros and cons, ranging from the consistency of the number on your paycheck to the actual number you can expect to see on your.

What is a “Draw Against Commissions” in a Sales Rep Team?

Salespeople might feel less motivated to reach their full quota, as their pay isn't directly tied to their sales performance. Draw versus commission is a pay structure where salespeople receive an advance (draw) against future.

Draw Against Commission Definition, Types, Pros & Cons

It balances financial stability with performance incentives, ensuring sales staff are compensated even during slower periods. Sales commission structures are usually designed to give an employee some control over how much they earn during a.

What is a “Draw Against Commissions” in a Sales Rep Team?

Firstly, during lean periods, they might end up accruing a sizeable debt that might take a few cycles to be repaid. Web a draw is a simply a pay advance against expected earnings or commissions..

What is a “Draw Against Commissions” in a Sales Rep Team?

Below are some of the pros and cons of using draw against commission: Web salesperson jobs view more jobs on indeed what is a commission draw? Web learn about the draw against commission system, including.

What is a “Draw Against Commissions” in a Sales Rep Team?

When employers use this payment structure, they pay employees a draw amount with every paycheck. Companies with steady clients may choose to pay under this plan. Web earning commission income can bring a range of.

A draw can increase the stress levels of salespersons on multiple accounts. Draw versus commission is a pay structure where salespeople receive an advance (draw) against future commissions. The pros of using draw against commission include: A recoverable draw is a payment an employer makes with the intention of recovery or reimbursement. In the case of a recoverable draw, underperformance may cause the employee to accrue debt over multiple pay cycles. Web a draw is a simply a pay advance against expected earnings or commissions. Commission serves as a motivating factor for an agent/representative to complete a deal and can even help align the performance of an individual with the organization. It adds a direct incentive to performance: When a company offers a draw against commission pay, it gives the employee a set amount of money at the start of their employment. Web draw against commission percentage of salary each has its own pros and cons, ranging from the consistency of the number on your paycheck to the actual number you can expect to see on your paycheck — some of which can be quite large. Sales commission structures are usually designed to give an employee some control over how much they earn during a certain time period. We’ll also discuss the pros and cons of. Below are some of the pros and cons of using draw against commission: Web 2 draw against commission; Pros of using draw against commission.